Tropical Battery Limited IPO Overview and Analysis

Tropical Battery IPO Summary

Tropical Battery Company Limited has filed an IPO with the Jamaica Stock Exchange and the Financial Services Commission. According to the prospectus, the company is seeking to raise J$ 325,000,000 for the company and its selling shareholders. Three hundred and twenty-five million (325,000,000) shares are on offer at a price of J$ 1.00 per share. The offer opens in exactly one week on September 22, 2020, and is expected to close on September 30, 2020. Of the 325,000,000 shares, 137,500,000 will be made available to the general public. The remaining 187,500,000 are reserved.

Ads by Google

According to the prospectus, “The Reserved Shares are initially reserved for priority application from, and subscription by, the following persons (the “Reserved Share Applicants”):

(a) 22,500,000 Shares for Directors, employees of the Company and the Mentor of the Company (the “Company Applicants”)

(b) 20,000,000 Shares for key stakeholders of the Company inclusive of executives involved in

the development of the businesses of the Company and its subsidiaries (the “Industry Partners”), and

(c) 70,000,000 Shares for investors (the “Strategic Investors”) and

(d) 75,000,000 Shares reserved for subscription by the Broker (the “Broker”).

If any of the Reserved Shares in any category are not subscribed they will be available for subscription by priority applicants in the other categories and thereafter, they will become available for subscription by the general public. All Reserved Shares are reserved but not discounted, and each Reserved Share is priced at the Invitation Price of J$1.00 per Share.”

Tropical Battery Limited IPO: Company Description

So who is Tropical Battery Company Limited? Tropical Battery Company Limited is one of Jamaica’s oldest battery distributors. The company has operated for more than 70 years as a distributor in the energy storage space. It sells different batteries for various devices and machines.

Sponsored

Funds to be used for expansion

Tropical Battery intends to use its portion of the proceeds of the IPO (J$162,500,000.00) for

expansion purposes. The company says it intends to:

1. Add new product lines such as start-stop technology, lithium ion batteries and other renewable storage products, tyres, and lubricants.

2. Renovate existing retail stores.

3. Expand its parking at their number one retail store at Grove Road, St Andrew.

4. Complete the buildout of and relocating to a new warehouse, head office, and retail store at Ferry, which is located on the busiest motorway in Jamaica.

5. Acquire and install information technology systems that will provide greater efficiency and improve their customer experience.

6. Expand their Mobile/ Home delivery fleet of vehicles.

Another portion of this J$ 162 million will be used to provide working capital for the company.

Tropical Battery IPO: Financials

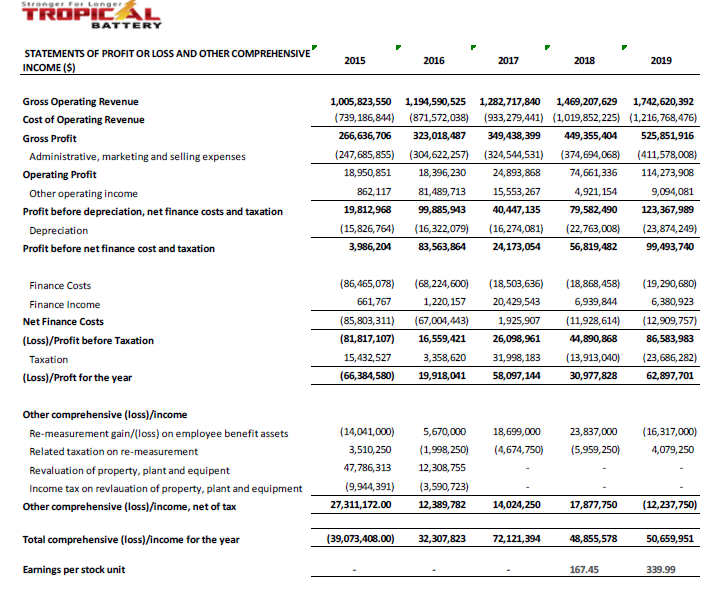

Within the last five years, Tropical Battery Company Limited revenues have grown 73.25% or an average of 14.65% annually. Similarly, the company’s gross profit has increased every year from 2015 when the gross profit was J$ 266,636,706 to 2019 when gross profit was J$ 525,851,916. This improvement in profits represented a 97.2% growth in the company’s gross profit. Value investors know that this isn’t the whole story so let’s talk more numbers.

Income Statement

Above is Tropical Battery’s Income Statement for the last 5 years (2015-2019).

Of the 5 years covered, Tropical Battery was profitable 4 out of the 5. The company’s profits moved from a loss of J$ 66,384,580 for the year to J$ 62,897,701 in 2019. Tropical Battery Company Limited reported an EPS of J$ 339.99 for the 2019 financial year. For the 9 months ended June 30, 2020, the company reported net profits of J$ 45,808,594 on revenues of J$ 1.36 billion. Net profit saw a relatively slight reduction of J$4,049,539 while revenues saw an increase of over 110 million.

As was previously mentioned, The company has shown robust growth year over year though it must be noted that the growth rate has slowed in recent years. Furthermore, it would appear that the 2017 year was an exceptional one for the company.

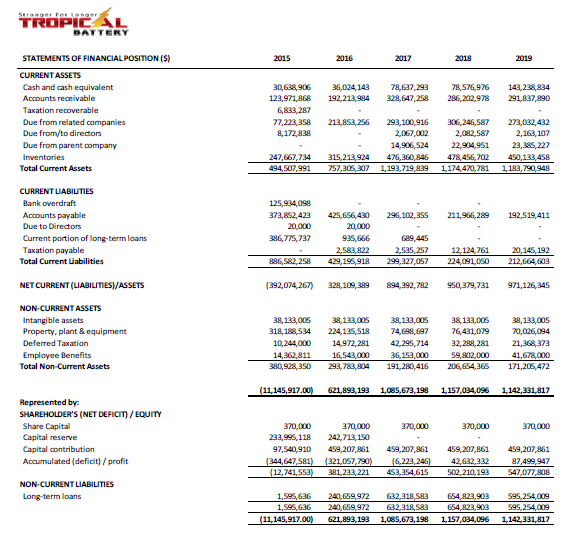

Balance Sheet

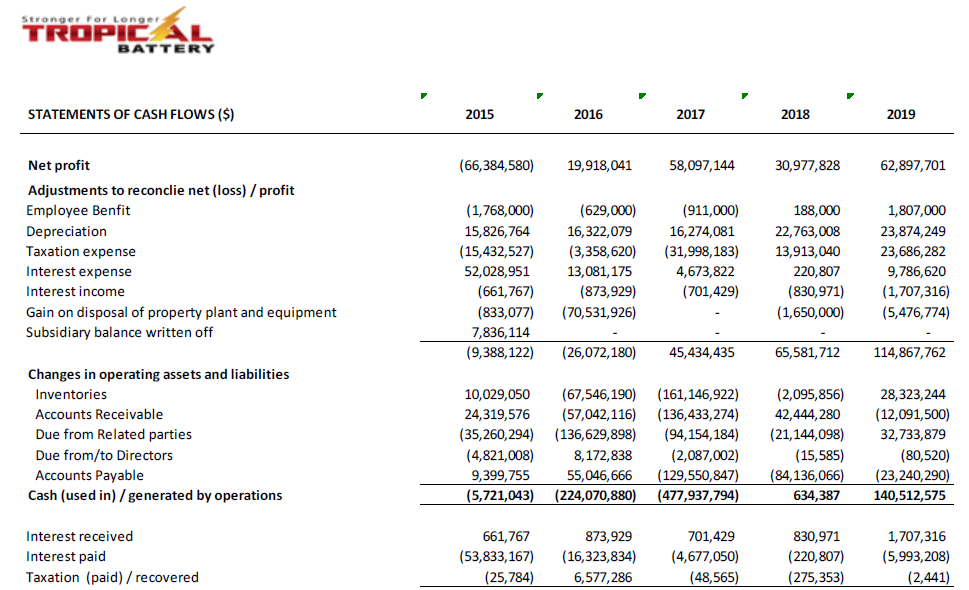

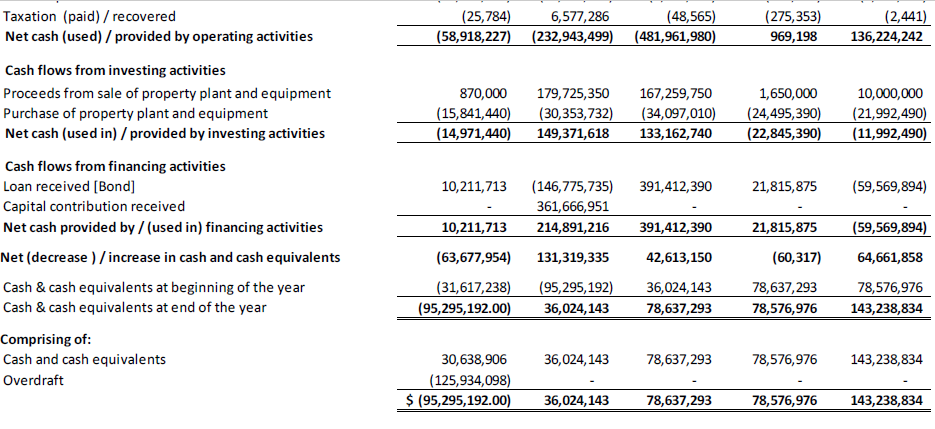

Cashflow Statement

You can view the full Financials in this PDF.

Tropical Battery IPO: Caribbean Value Investor Opinion

Caribbean Value Investor rates Tropical Battery Company stock as a BUY based on a number of qualitative and quantitative factors. These include:

– Strong Balance Sheet

– Robust growth, that will be bolstered by the IPO and the subsequent tax breaks.

– Great liquidity position (based on the J$ 143 million cash pile that the company has on hand)

– A well-established brand.

– Good revenue growth despite the ongoing COVID-19 pandemic.

– Diversification in terms of segments of the market served.

Valuation

Using the Price-Earnings (P.E.) Multiple method of valuation. We estimate a forward PE ratio of between 22X and 25X for Tropical Battery Company Limited. This is based on an estimated 2020 full-year earnings of J$ 55,000,000 – $ 58,000,000, the incorporation of J$ 137,500,000 from the IPO, and the exemption from income tax charges. While the PE Multiple might seem high given the current economic situation we believe it is offset by Tropical’s position in the market and their plans for expansion.

On a less fundamental level, we have continued to observe a trend in IPOs where companies seeking to raise up to the maximum amount of capital for listing on the Junior Market of the Jamaica Stock Exchange (J$ 500,000,000), end up being oversubscribed. This is further underscored in the case of Tropical Battery Company Limited by the fact that just over half the shares coming to the market are available for subscription by the general public. Caribbean Value Investor, therefore, expects that the offer will be closed on the Opening Day and that demand for the shares will result in some amount of capital appreciation shortly after listing.