Carreras’ Last Puff?

Carreras

Carreras Limited, Jamaica’s cigarette manufacturer is feeling pains in its business as Special Consumption Tax on cigarette begins to bite. Each time the government is seeking to fill its coffers it turns to a product that is highly utilized, and one such product is cigarettes. Compared to others, it is the perfect candidate.

Advertisement

Cigarettes

Cigarettes are highly addictive and non-essential. Two wonderful combinations for any government seeking an item to tax. The addictiveness of it will ensure recurring income for the government and its non-essentiality will limit public backlash. I’m sure the former is why Carreras is in the business to begin with. However, they are now being faced by multiple challenges. The government SCT has driven up the cost of the cigarette beyond the reach of its many normal customers. It has also led to the unintended consequence of driving these customers to illegal cigarettes. Now Carreras has a multifaceted problem. An erroneous tax, legal and illegal competition and of course the usual health warnings about its cancer-causing product.

Challenges

Like its loyal customers Carreras appears to be addicted to its own product. The government of Jamaica seems to be enjoying revenues coming from SCT on tobacco and Carreras have had enough time to realised that. Therefore, seeking alternatives revenue should have been a priority. I am doubtful the government will ease up its tax. Yes, the illegal cigarettes are dampening the government revenues, but taxing cigarettes are a good way of recovering the cost spent on health care as a result of patients with lung cancer. Also, if they decrease tax on a product that attracts a lot of bad publicity they will be forced to reduce it on let’s say fuel. And with the current fiscal consolidation agenda that is a ‘no no’.

If the Jamaican government cannot stop something deadly as a gun from coming through its borders, I’m doubtful that in their current capacity they will be able to stop a slim item measuring less than 10 cm from entering.

Sponsored

So, unless Carreras plan to use its hefty cash pile to build the government’s capacity then they are in a death spiral. So, with not much solutions abound Carreras is left with two options, spend their hefty cash pile on a losing battle or use it to enter a new business.

Tax Axe

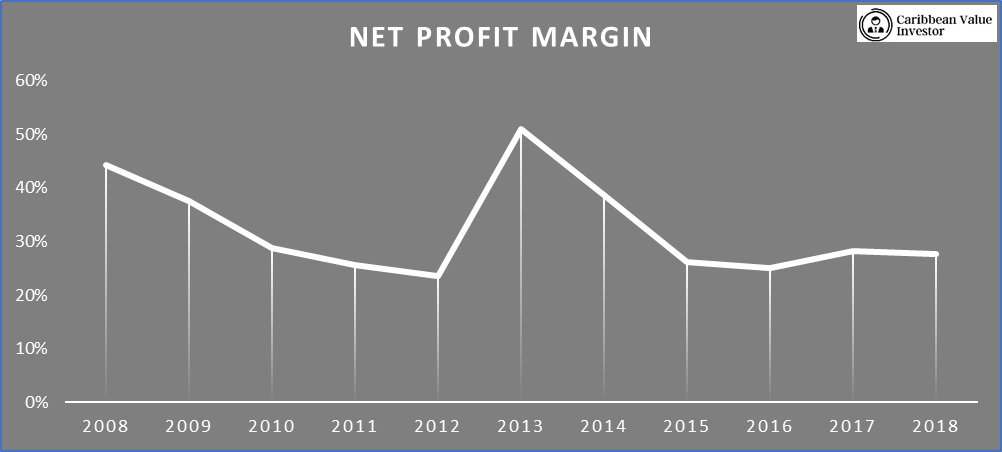

In 2009 the tax was $2.50 on each stick of cigarette with the average retail cost of each being $20. The government expected to yield $1.84 billion on that. Carreras’ 44 % profit margin earned in 2008 was clearly not going to get pass the government’s lips without it taking a bite. Fast forward to 2016 and the tax was at $12 before the 2016 budget and rose to $14 after the budget. A clear sign the government was in love with this tax. The average cost of cigarette was $40 before the budget was read in 2016. This hike was expected to increase the governments earnings from the tax by $574 million. In 2017, the tax saw a 21 % upsurge to $17. An increase that appears to be too much for Carreras and its shareholders this time around.

Money Talk

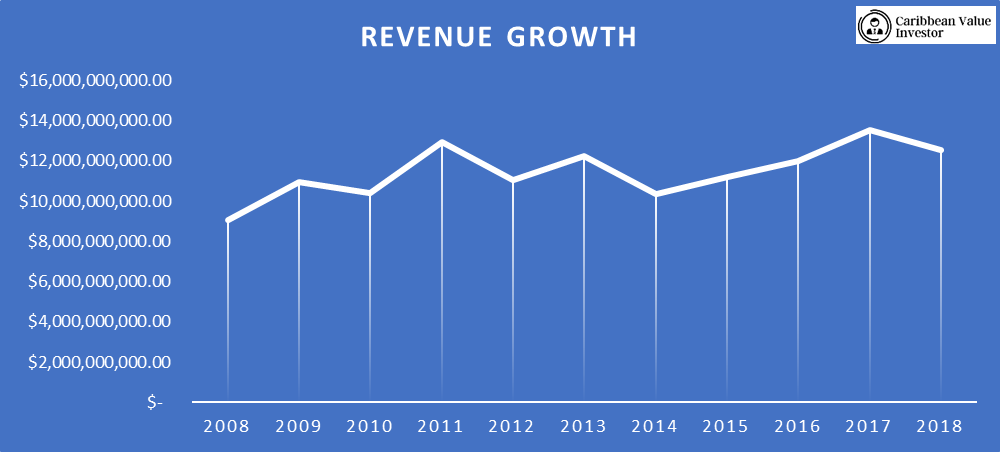

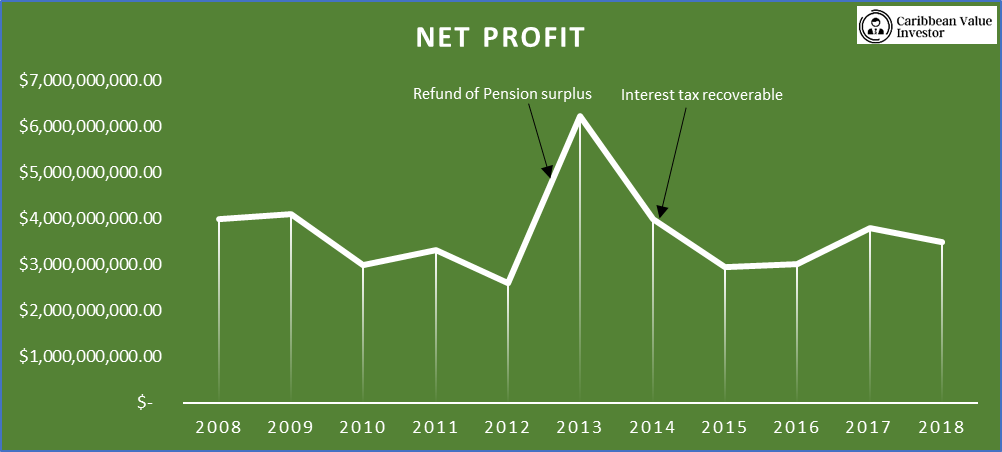

Figures below show that even though the SCT has dramatically increased since 2009 it has not caused a major fall off in revenues or profits for Carreras. There was a 7 % and 8 % drop in revenues and profits respectively between 2017 and 2018 report. But, Carreras was still able to maintain a net profit margin of 28%. Further examination over the last 10 years shows that Carreras is resilient to the increase in the SCT, as they are able to recover revenues after each hike. The question is, are the last round of tax increase in 2017 the damaging blow? Too early to tell. Carreras may not be able to attain a 44 % net profit margin like in 2008 but its 28 % in the face of all these challenges is still good. It has managed to control its expenses which has lesson the negative impact of the competition and taxes.

Advertisement

Sponsored

At the end of Financial year ending March 31st, 2018, cash and cash equivalent stood at $2.3 billion. Current PE is 13 and book value per share stands at $0.42. The low book value brings into question whether the company has enough assets to weather the storm or restructure its business. A lack of revenue diversification, no clear strategy from the management and little assets should be major concerns for investors.

See also: Is The JSE primed for another takeoff?

Sponsored

For analysis like this contact us at: info@caribeanvalueinvestor.com

Disclaimer: The opinions expressed in this article are solely those of the authors and are in no way intended to reflect management’s views. Further, all information provided on Caribbean Value Investor is strictly for educational purposes. Caribbean Value Investor, its Directors, Employees and Stakeholders accept no liability in respect to gains or losses experienced by readers.