Is JSE primed for another takeoff?

Is The JSE primed for another takeoff?

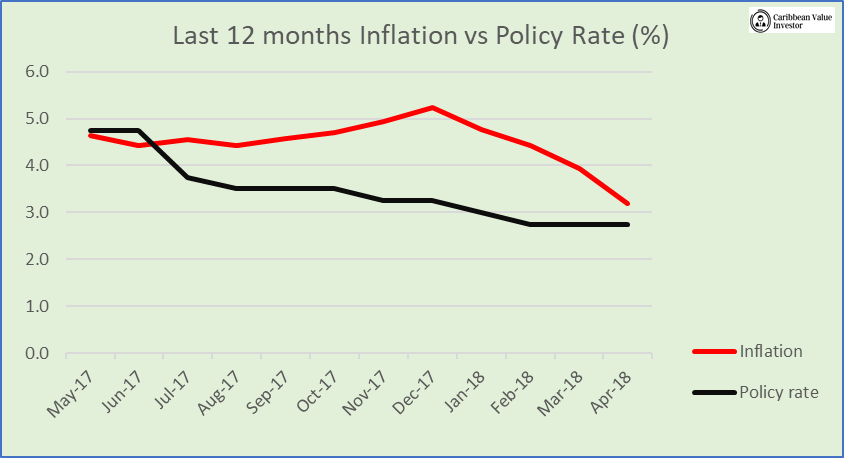

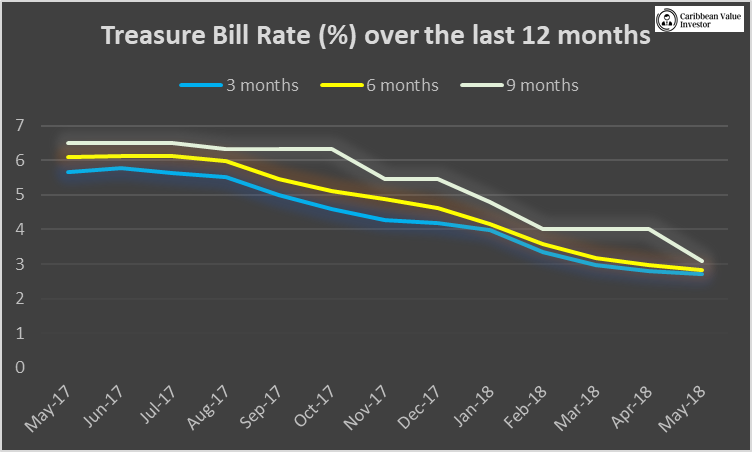

In May, the BOJ reduced interest rates to 2.5% making government paper far less attractive than other investment instruments. This has been on a steady decline and it further brings it below the rate of inflation which came in at 3.2% (see graph below). The steady decline in the rate of inflation is what is driving lower interest rates as was hinted by BOJ’s governor Brian Wynter. The BOJ is aiming to have inflation between 4 to 6% but Wynter is projecting this to hang around the lower end of this spectrum. Therefore we expect further declines in rates (as suggested by the governor) in an effort to prop up inflation.

With Treasury bills rate being lower than the rate of inflation, investors invested in government paper will be seeing a reduction in earning potential. The current administration is curtailing the government’s debt appetite and as demand outweighs the supply of government paper, expect lower rates as more capital competes for fewer bond issuance therefore driving down the rate.

Lower Debt to GDP Ratio

Overall this is one of the government’s strategy to not only lower the Debt to GDP ratio in order to have more money to spend on capital expenditure but to reduce the government’s footprint in the markets. This is expected to encourage money to flow into the private sector. It will almost certainly make Initial Public Offerings (IPOs), preference shares and corporate bonds more rewarding for companies. This being the natural result as more capital will be competing for space to park. We expect more companies to enter the capital and corporate bond markets as rates on instruments will be more favourable. Investors can therefore gear up for these and continuously check CVI for valuable analysis to see the potential rewards and risks.

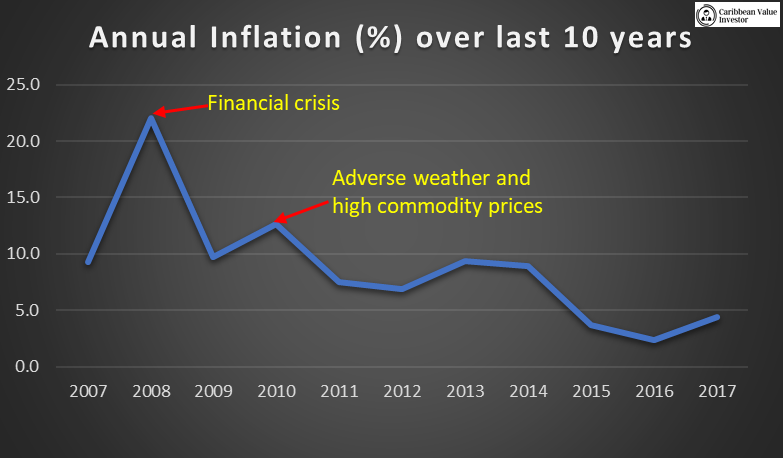

Lower Inflation

Lower inflation is expected to continue boosting consumer confidence which could translate to more consumers departing with their capital. This may boast revenues for companies directly or indirectly. Lower inflation means a lower rate of erosion in purchasing power and a stable exchange rate can keep prices competitive; reducing the cost to import raw materials when the JMD has to be converted to hard currency. This holistically is expected to boost profits of companies who position themselves for this outcome. Pricesmart, although not listed on the JSE, is a retail outlet looking to expand. Outgoing Chief Financial Officer John Heffner cemented this point in an interview with the Financial Gleaner that sales have increased and one contributing factoring is the strengthening of consumers’ purchasing power.

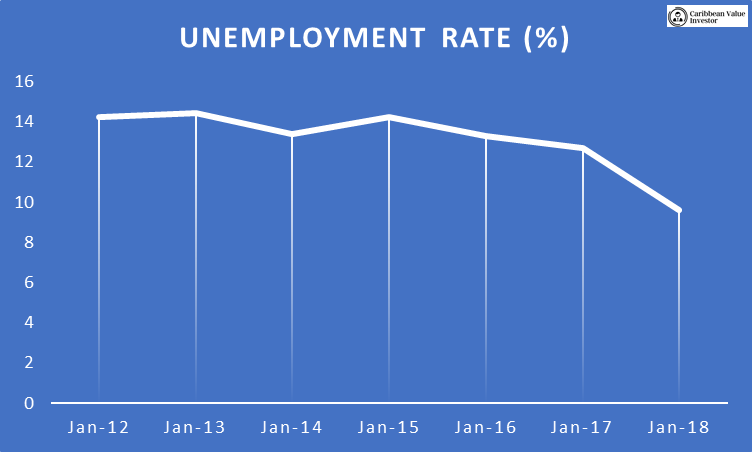

Reduced Unemployment Rate

Reduction in the unemployment rate is also expected to help boost companies’ earnings. As employment increases more people are equipped with capital to conduct purchases of goods and services. In theory, this should result in more earnings for companies. Largest increases in the number of persons employed were recorded in the wholesale and retail sector, followed by construction, hotels and restaurants. An increase in the labour force by companies in these sectors is an indication of the potential revenue growth and business expansion.

Source: Statistical Institute of Jamaica

Source: Statistical Institute of Jamaica

Expect more allocation of pension funds to blue chip stocks. As treasury bill rates decreases, conservative investors will be looking to other assets with lowers risk and blue-chip stocks are a candidate. These stable and relatively ‘safe’ stocks have a proven track record that is testimony to their performance and management.

These companies are financially sound and are market leaders in their respect industries. With more people working, especially in quality jobs, and the government passing the pension reform bill in September 2017 which requires all pensionable officers to contribute to a scheme, inflows into these stocks are expected.

So Is the JSE Primed?

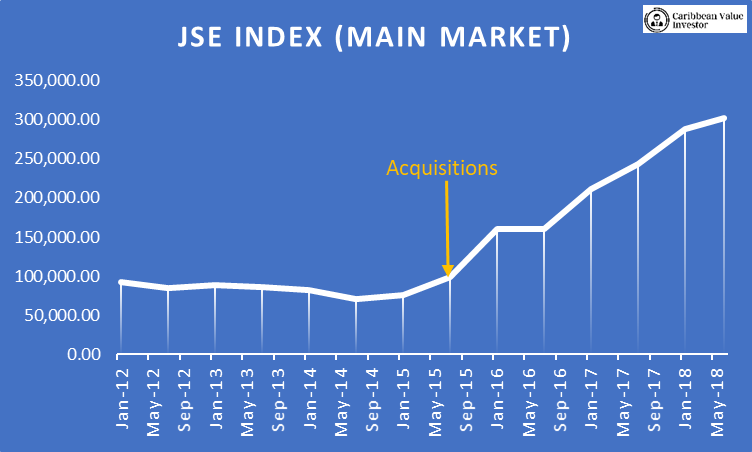

With these factors, and others collectively at play, the questions now to be asked is whether the JSE is worth sending capital into. Over the last three years the JSE has seen a major bull run that has slowed down in the last quarter.

JSE Main Market Index – JSE Take Off? – Caribbean Value Investor

JSE Main Market Index – JSE Take Off? – Caribbean Value Investor

Table showing market averages

| SECTOR | MAIN MARKETS | JUNIOR MARKETS | ||

| Average Price to Earnings Ratio | # of companies trading below | Average Price to Earnings Ratio | # of companies trading below | |

| Finance | 15 | 7 | 26 | 1 |

| Manufacturing | 21 | 4 | 24 | 3 |

| Communications | 14 | 0 | N/A | N/A |

| Retail Trade | 15 | 3 | 20 | 4 |

| Tourism & Other Services | 18 | 2 | 23 | 4 |

| Insurance | N/A | N/A | 54 | 1 |

| Overall Market | 18 | 21 | 22 | 17 |

With the Price-Earnings-Ratios of each industry presently between fairly to overpriced on the different markets, one needs to examine individual companies who fall below their industry average to find opportunities.

Caribbean Value Investor offers services geared towards such investigations. Feel free to email us at info@caribbeanvalueinvestor.com if you are interested in an analysis on a specific company or sector.

Alternatively, you can reach us using the Contact us page on this website.

It does appear that investors are hesitant to act at this moment but that may change if earnings pick up with the new found confidence in the economy. The main market looks to garner the attention in the coming quarters particularly the financial sector.

Suggested Reading: TOP 10 Companies listed on The JSE by Market Capitalisation – Caribbean Value investor

Banks are being encouraged to offer more attractive rates to customers especially considering the new low interest rate environment we are entering. However, banks have been reluctant to make any drastic move in their rates. Nevertheless, fewer treasury bills and at lower rates will force banks to issue more money at lower rates and to invest into other instruments to main their profitability. With the newly found confidence in the economy investors should take a look at retail companies as well. As consumers move up the social mobility ladder they begin to acquire products and services to improve their living conditions. In our view, The Main Market overall looks to receive further capital injection.

On the other hand, the Junior Market appears priced in, but further growth is expected to come from the IPOs slated to be launched this year, assuming they can come to market in time and at a reasonable value. Investors should therefore focus on the upcoming earnings for the Junior Market as this will be the major influencer in any further movement in this market.

Disclaimer: The opinions expressed in this article are solely those of the author (s) and are in no way intended to reflect management’s views. Further, all information provided on Caribbean Value Investor is strictly for educational purposes. Caribbean Value Investor, its Directors, Employees and Stakeholders accept no liability in respect to losses (and no credit in respect to gains) experienced by readers.