How Value Investors Select Companies and Buy Stocks

Value Investors Select Companies Selling At Prices Below Their Intrinsic Value

I recall listening to Warren Buffett share his view of buying business at a discount. It intuitively made sense. We all like to buy things on sale. Our approach in investing should be no different. Value Investors choose to buy stocks in established companies while they are selling at a discount to their intrinsic value. That being said, it is very important to understand that a company has a market or sticker price on it. That price may vary widely from its intrinsic value. The intrinsic value can be calculated using various methods, I tend to follow the top down approach and apply the use of Discounted Cash Flows. Another method may be to look at the current value of the assets held by the company vs its liabilities. Additionally, we can use financial ratios such as the Price to Earnings (P.E.) Ratios, Income to Assets Ratios, Current Ratio, Quick Ratio, among others to arrive at a value for the company. We will talk more about valuations in upcoming articles.

Even with this criteria “It is better to buy a good business at a fair price than to buy a fair business at a good price.” ~Charlie Munger. This is the principle that has made Charlie Munger and his partner Warren Buffett multibillionaires.

Profitability – Value Investors Select Companies with Profit Potential

The ultimate aim of investing is to realise a profit. Therefore, profitability is very important pillar for successful value investing. Let me differentiate between profitability and profit-ability. Normally when Analysts and Investors speak of profitability, we are looking at the past performance of the company and using profitability ratios to assess how profitable the company has been. However, for successful value investing, we must consider another perspective of profitability. We must not only look at the history of the company through profitability ratios, but also through the lens of the company’s ability to realise, continuous and growing profits in the future.

One example of this is a business that deals in consumer staples. These businesses have an edge because they can continually keep their capital working. If they have a high market share. A great business is one that has a high margin and is able to reinvest the profits of the company into the business.

Advertisement

This is the compounding element of investing that value investors seek. We want to hold stocks in companies that can reinvest say 20 cents out of every $1.00 they earn. A company with a high Return on Tangible Assets (ROTA) will likely also have a high margin if it is protected by a moat. It is therefore important for the Value Investor to understand the importance of the business model of the company he is intending to invest in.

People – Value Investor Select Companies with Capable, Credible and Competent People

Many value investors, myself included, invest not only in a business but also in the people running that business. I think Management is a key qualitative metric in assessing the intrinsic value of a company. Why? Think for a moment who came up with the idea for the business, what does their track record indicate about them? Are they trustworthy? Are they competent? What vision do they have for the business? Are they playing the long game? Can they endure three years in the red for the betterment of the company, it’s employees and it’s shareholders?

Advertisement

Value Investors select companies that have competent management teams at their helms. The value investor wants to know such things as; What is their motivation for being in the business concerned? Do they have interpersonal issues that could lead to the demise of the business? Who is their ideal employee? Who is their typical employee? What type of culture are they fostering in the business? In my opinion, these are all very important questions and worth investigating. Even if only on a superficial level.

Practicality

This might seem like an odd criteria for successful value investing but give me a minute and I’ll explain. The typical “Investor” is looking for the best place to put his money. He wants it in and out in the shortest possible time, with the maximum possible return. It is for this very reason that so many “Investors” lose their money in the stock market. They then proceed to forever curse the infrastructure. The fundamental investor differs. He applies the question of practicality to his investment options in order to be successful. Successful value investing requires us to consider the practicality of the business. A case in point is SNAP Inc. In March of 2017, SNAP Inc, the parent company of social media application SNAP CHAT issued an initial public offering (IPO) of 200 million shares with an invitation price of USD 17.00.

On the first day of trading the stock rose 44% (yes, you read that correctly) to USD 24.00. However, there were fundamental problems. The practicality of SNAP’s business was questionable and made worse by the fact the company had no profits. SNAP’s practicality as an investment can be assessed by considering the following facts.

Advertisement

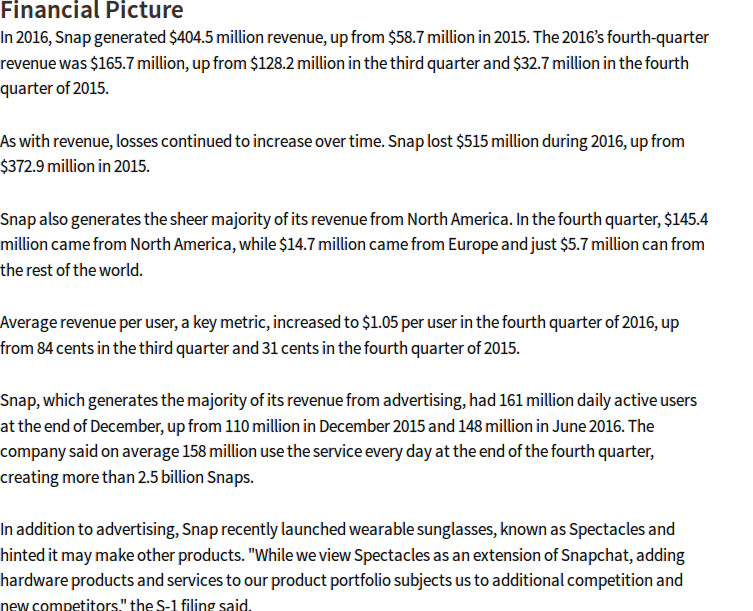

1. Nearly all of its features had been copied by Facebook, Instagram and WhatsApp. Furthermore, Facebook, the social media network (and by the time you read this, the Advertising Giant) owns two of SNAP’s rivals, Instagram and WhatsApp. All in all, the long term prospects do not look enticing for SNAP. Again, at the time of the IPO, the company had not yet realised a profit (see profitability) and with user growth growing at a more or less flat rate, the future income did not seem secured (see profit-ability). The following screenshot of an article from investopedia.com will allow you to run your own numbers.

Image Captured from: https://index.investopedia.com/index/?q=SNAP%20Inc&o=40186&qo=investopediaSiteSearch on April 12, 2017

Image Source: http://www.investopedia.com/news/snapchat-ipo-what-you-need-know-snap-fb/?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186

Consequently, the point here is that, at the time of SNAP’s IPO, the company was not a practical investment from a value investing perspective. The price of SNAP shares at the time of this publication was $13.20, a 22% decline from the IPO price. Again, successful value investing requires us to view our investment options from a practical point of view.

Psychology of the Market

Human psychology has not changed much throughout the centuries. Our mental processes have, by and large, remained the same. This fact has both positive and negative implications for the Value Investor. On the positive side, we are able to capitalise on negative emotional responses to the markets.Widespread pessimism about the market tends to make investments cheap. On the negative, we look like idiots when we are warning people about a particular investment that has been rising without pause. A small side note, Value Investors seem to always make most of their money following a market reversal.

Value Investors Select Companies that show long periods of historic positive performance

I do not believe it is unfair to say successful value investing is predicated primarily on the historic performance of companies. That being said, past performance is not always indicative of future results. This is especially true in unstable industries. Innovation and disruption are also key considerations with respect to this point. Thus Value Investors also have to look at the performance of the sector in which the company operates.

The Most Important Thing : Patience

I intentionally saved this point for last. The simple reason is that Patience is possibly the most important of all the considerations. I could give you countless examples of legendary value investors who have succumbed to the trap of losing patience. Ben Graham and his student Warren Buffet have done it, Mohnish Pabrai has done it, Bill Ackman has done it, Sir John Templeton too, among many others.

Advertisement

I am still on my #Journey to becoming a value investor but already I have made that mistake numerous times. The most challenging thing in successful value investing is patience. It takes quite a lot of emotional fortitude to stay the course once we have made an investing decision based solely on fundamentals. The reason for this is simply that most people are not doing that type of investing and in the short term the market will make us look like buffoons.

Suggested Reading: How to Buy Stocks on the Jamaica Stock Exchange

Pingback:Ten Stocks We Chose - February 2019 - Caribbean Value Investor - Articles and Analysis

Pingback:I Am New to Investing: Help!!! – Cerebral Massage