138 Student Living Reverses Losses

For the 3 months ended December 2019, 138 Student Living Limited (138 SL) recorded revenues just shy of 464 million. This represents an increase of 108% over the 223 million recorded for the same period one year earlier. Expenses and finance costs, on the other hand, were contained at 205 million and 67 million respectively. During the quarter, the company made a full reversal of the 43.8 million loss reported for the 2018 December quarter.

The quarter’s results benefited from a variation claim for 2019 and the first quarter claim for 2020. The claims related to the construction of Irvine Hall, one of the 4 halls built and operated by the company. The company is reporting that its adjusted earnings for the quarter would be 33 million if the variation claims were not considered. It is expected that growth will continue at a slower pace for the rest of the 2020 financial year.

Financial Performance Improved

Profit from operations improved by more than 10 times, moving from 19.7 million in 2018 to 259 million in 2019. Administrative expenses of 205 million for the 3 months ended December 2019 compared favourably with the 203 million recorded for the 3 months ended December 2018. The company paid taxes of 8.39 million for the quarter with net income of 182.86 million. 138 Student Living had reported a net loss of 43.84 million for the December quarter of 2018. EPS for the quarter ended December 2019 was $0.44 per share compared with a loss per share of $0.11 for the same quarter a year before.

Balance Sheet

Sponsored

Current assets saw only a marginal decrease moving from 755.3 million in 2018 to 738.8 million, largely due to a decrease in both cash and short term deposits. Despite this, total assets saw a 2.27 billion improvement owing to an increase in the service commission rights. There was an increase in current liabilities which moved from 743 million to 1.17 billion. Non-current liabilities were paid down from 4.86 billion to 4.25 billion.

Both fair value reserves and retained earnings saw significant improvements for the quarter bringing total equity to 5.73 billion.

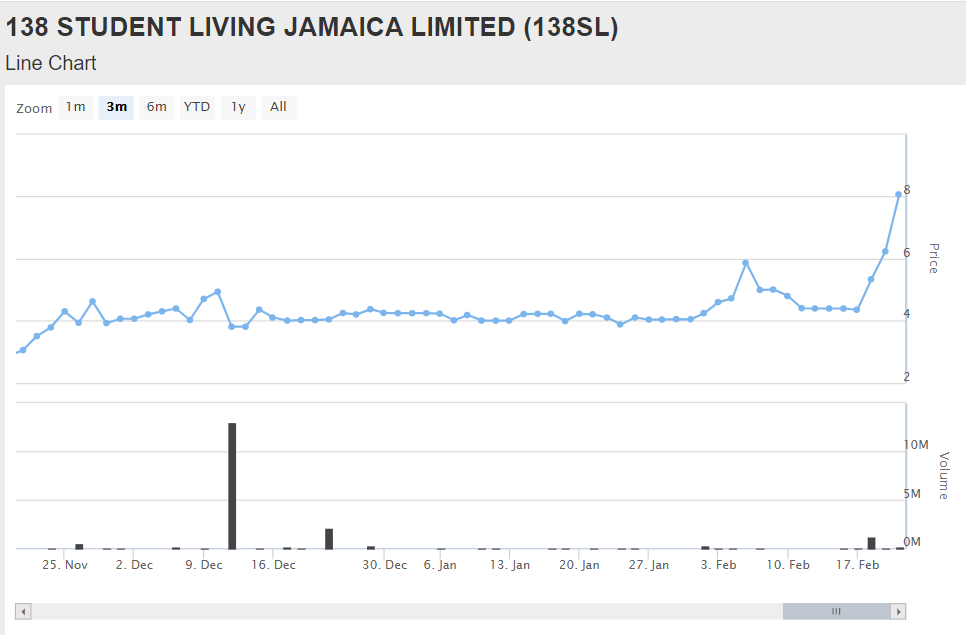

Stock Price Up Near 200%

138 Student Living stock last traded at $8.00 per share. The stock traded at $3.00 per share just 3 months ago and was trading relatively flat around J$ 4.00 per share for the entire month of January. 138 SL stock is up nearly 100% since the start of February and is up nearly 200% from its 3 month low.

Opinion

With an estimated book value of J$ 9.00 per share 138 Student Living is currently approaching its fair value. Capital gains aside, the company seems to be performing better. However, with a debt to equity ratio of 0.95 and a current ratio of 0.63 for the quarter ended December 2019, it remains to be seen whether 138 Student Living is out of the woods for good.