BYND with 40% potential upside

“BYND releases their ER Monday after the close. If the report ends up sending the stock downwards, a trade opportunity might open, anticipating a short-squeeze.” This was our statement about BYND some days ago, here. Our hypotheses turned out to be correct. At today’s price BYND has retraced 26%. Today there might be a great buy oppertunity for the beyond meat stock.

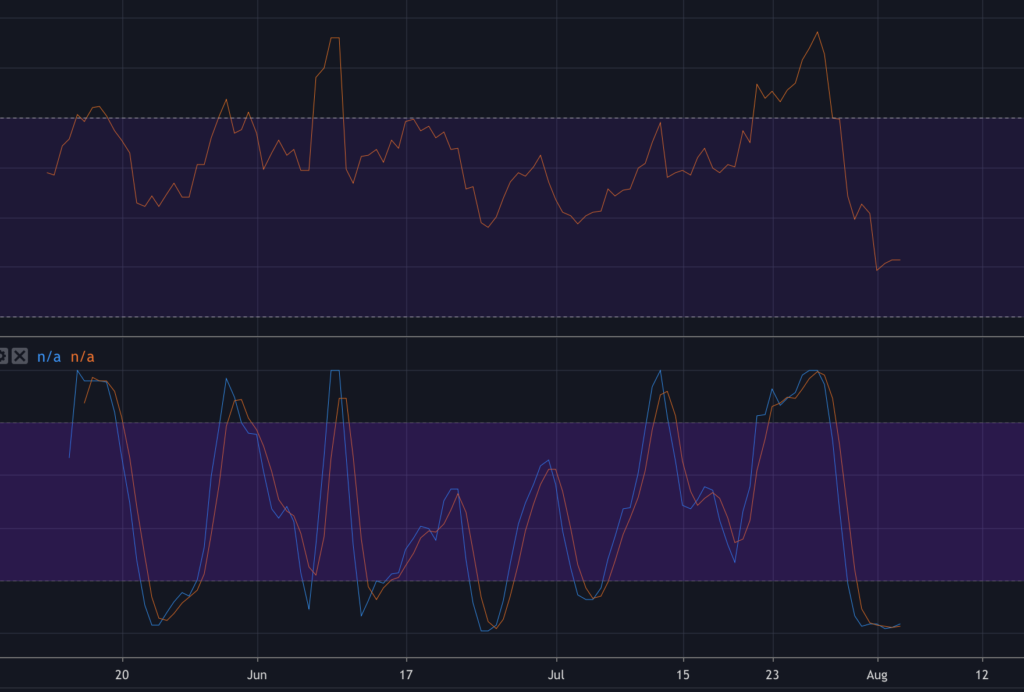

The chart is bullish

There are two lines you need to pay attention too. The upper one is showing a somewhat apparent resistance. The lower trend line is the more important one, the support. Most trades we take are either at breakouts, or at support. Chances are BYND will bounce on support.

RSI and stochastic RSI bouth show oversold

We could further support this argument by looking at some of the indicators. Both the RSI and Stochristic RSI shows oversold conditions. Together with the trend line, as well as the nature of BYND with it being a hype stock, I do belive we have ourself a trade.

How to trade it

As always, one should use technical analysis together with fundamental analysis for the safest trade. Trading only based on technical analysis is not recomended, so please, do your own research. I will participate in this trade myself. From this point, I do look at this as a more risky trade then usual, so the position size would be reduzed. I would also use a thight stop loss. If the support line breaks (unlikely) I do belive BYND would fall rapidly, so stop-loss would be around 165$. Giving us a potential return of 40%, and a maximum loss of 6%.