Sagicor Select Fund IPO in July

Sagicor Select Fund IPO will raise approximately 4 billion if the initial public offering is successful in July. The offer is slated to open at 09:00 am on July 03, 2019 and should close within two weeks on July 17, 2019 at 2019. Final allotment and admission of the shares should be within three to four weeks of the closing date.

What is the Sagicor Select Fund?

Sagicor Select Fund (SSF) is a newly formed company that was set up by Sagicor Group Jamaica Limited to trade securities. The company was incorporated on January 11, 2019. According to the prospectus, the company has been structured as a “passive Listed Equity Fund“. The company will be primarily involved in the trading of securities on recognised exchanges.

Sponsored

It is important to note that the company is set up with 5 classes of shares (A-E). The Class A share (there is only one (1)) is held by Sagicor Investments Ja. Limited and has special rights associated with it. The other four classes of shares will represent a separate fund within the company. The company currently only has one fund, the Financial Select Fund. The shares being offered in this IPO are shares in the Financial Select Fund. This means that in future we could see Sagicor Select Fund Limited issue another prospectus for another of its funds with shares from the C,D or E class. However, the company has not stated any such intentions.

The Financial Select Fund

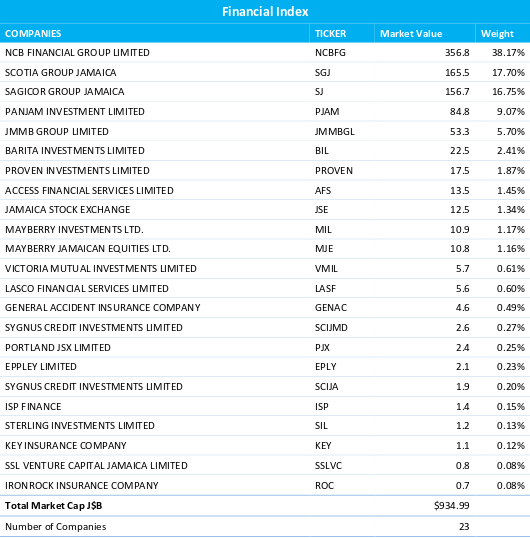

The Financial Select Fund will primarily invest in securities listed on both the Junior and Main Markets of the Jamaica Stock Exchange. The Fund will track the JSE Financial Index which comprises the 23 financial securities listed on the exchange across all three markets. The Financial Select Fund is currently made up of 10 of those securities. The JSE Financial Index is shown below.

The securities owned by the Financial Select Fund are covered under the next section.

What does the company own?

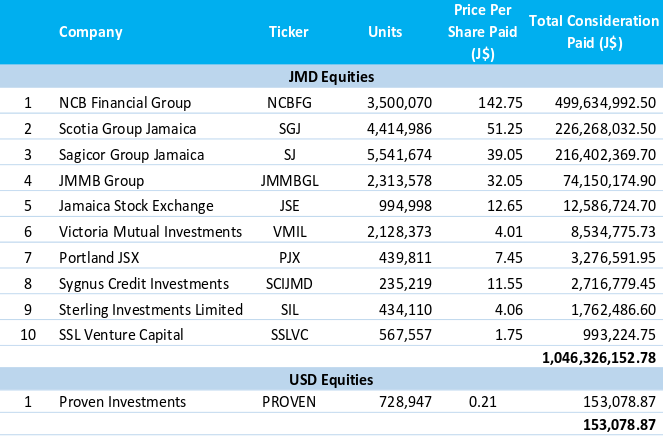

Below is the list of 11 securities currently held by Sagicor Select Fund. The fund has positions in 11 companies namely, NCB Financial Group, Scotia Group Jamaica, Sagicor Group Jamaica, JMMB Group, Jamaica Stock Exchange, Victoria Mutual Investments, Portland JSX, Sygnus Credit Investments, Sterling Investments, SSL Venture Capital and Proven Investments Limited.

It is important to note the purchase price of the securities. NCBFG for instance was bought for $142.75 but closed trading at J$189 today. Sagicor Group, bought for J$ 51.25 per share in March, ended trading at J$ 57. Also important, is the fact that SSLVC which was bought J$1.75 per share was recently granted approval for trading of their shares to be suspended. The official notice posted on the Jamaica Stock Exchange website read “SSL Venture Capital Limited (SSLVC) has submitted an application for a suspension of trading for the period June 20, 2019 to August 14, 2019. The JSE has granted approval for the suspension effective June 24, 2019.”

The company has no registered trademarks and does not own or rent any real estate.

The company has no registered trademarks and does not own or rent any real estate.

How much will the shares cost?

Ordinary Shares priced at J$ 1.00

The company is offering 2.5 billion “Class B” redeemable voting shares at J$1.0 per share. The company also reserves the right to issue a further 1.5 billion ordinary shares at J$ 1.0 per share. Applicants will also be required to pay a J$ 140 Depository Fee plus G.C.T. (totaling J$ 163.10) irrespective of how many shares they are applying for. The minimum amount of shares an investor can purchase in the IPO is 1000 units. An investor can therefore get in on the IPO with J$ 1163.10.

Reserved Shares priced at J$ 0.98

Of the total shares, 1 billion shares are initially being reserved for Sagicor’s Sigma clients and Sagicor employees. 500 million shares are being reserved for persons who are unit trust holders of Sagicor’s Sigma Funds as at May 31, 2019. If on May 31, 2019 you had Sagicor’s Sigma Fund unit trust product then you qualify as part of the reserved pool. The other 500 million shares are being reserved for Sagicor Employees. The reserved shares are being offered at J$ 0.98. The depository fee and G.C.T. also apply.

What are they going to do with the money?

According to section 6.3 of the prospectus, Sagicor Select Funds intends to use the proceeds of the IPO to buy more stocks/securities to match the JSE Financial index as closely as possible. The company has also stated that it intends to pay ~40,000,000 in expenses associated with the invitation. That 40,000,000 should cover the Arranger fees, Auditor and Accounting fees, Brokerage fees, financial advisory fees, legal, marketing, registrar and transfer agent fees as well as the Statutory fees including initial listing fees.

Will I get dividends from the company?

In short, the answer is yes. The company intends to pay out 90% of their net cash to shareholders. It is important to note however that dividends paid by the companies held by Sagicor Select Funds will be made to SSF and not directly to the people who have shares in SSF. So if NCBFG declares a dividend, the money will go to SSF and from that, SSF will pay out a dividend to you the shareholder. The company states that the average dividend declared and paid to its shareholders should reflect the average dividend yield of the Financial Index.

Sagicor Select Fund IPO Valuation

The value of the fund is calculated using the Net Asset Value (NAV) approach. The NAV is calculated by taking the total value of the underlying assets, subtracting the fund’s liabilities and then dividing by the total amount of shares in the fund. The job of calculating the NAV in this case was given to the JSCD Trustee Services. They will calculate and publish the NAV daily on the JSE website. The NAV will also be published on Sagicor’s website.

Is Sagicor Select Fund IPO A BUY?

Frankly, I cannot tell you whether it is a buy or not for you. I am not a Financial Advisor, moreover, I am not YOUR Financial Advisor. What I can do is present you with my view of the offering. I have already written about mutual funds and why I think they are good for the first time investor. I think index funds are even better! I am not the only one. Warren Buffett advocates for index funds as well. He is quoted saying “The novice investor should buy an index fund”.

That being said, it is important for me to highlight the fact that the Sagior Select Fund is a concentrated fund, at least initially. In its current state it is only invested in the financial sector. In fact, what is being listed is the Sagicor Financial Select Fund.

One might also cite the fact that it is buying companies on the Jamaica Stock Exchange as another concern. However, since the largest holdings in the fund are NCB Financial Group and Sagicor, I wouldn’t worry about that since both of these companies have Caribbean wide exposure.

Advertisement

What I can say is that if you are bullish on the Jamaican financial sector, then the Sagicor Select Fund gives you that ability to basically own a piece of the sector. The advantage to owning an equity fund is that an investor is able to purchase a single security that has an interest in a group of companies. In this case, the companies are all in the financial industry so that must be considered.

What are the risks?

As mentioned earlier, the major risk is that the fund is concentrated in the financial sector. The prospectus also outlines the following additional risks.

- Index Tracking Risk – Re-balancing the fund to match the index will cause it to incur cost of buying and selling securities.

- Non-Diversification Risk – Due to the low number of securities that the fund is invested in, a decline in the price of its major holding will have a severe effect on its NAV.

- Market Risk – Inherent risk of being invested in the securities market. To put this into perspective, the prices of securities go up and down and are affected by economic conditions.

- Asset Class Risk – Being that the Fund is invested only in equities, it has the inherent risk of exposure to the equities market.

- Local Economical Risk – The risk of investing in the Jamaican economy. The Sagicor Select Fund is susceptible to a weakness in the Jamaican economy or a decline in our financial markets.

- I will also add Regional Risk and Natural Disaster risk.

Opinion

I think the Sagicor Select Fund IPO is being offered at an attractive price. This is based on the invitation price of $1.00 being approximately 30% lower than the Net Asset Value of J$ 1.32 projected by year end 2019. Furthermore, the economic growth that we have been experiencing is projected to continue for the foreseeable future with the many infrastructure projects currently being undertaken.

Financial institutions have committed to making it easier for small businesses to access resources which will in-turn bolster their own performance. We are also seeing various significant shifts in the financial sector, multi-billion dollar deals have been brokered among NCB Financial Group and Sagicor as well as PROVEN Investments and JMMB. Lastly, the ambition of the current administration to make Jamaica a financial stronghold trough the establishment of an International Financial Services Centre will auger well for the financial sector.

Sagicor Select Fund vs Mayberry Jamaica Equities

Sagicor Select Fund is not the only Equity Fund listed on the Jamaica Stock Exchange. Another publicly listed equity fund is Mayberry Jamaica Equities (JSE: $MJE) which listed last year. In an upcoming article, I will do a comparison of the two funds weighing in on the advantages and disadvantages of each.

Subscribe to Caribbean Value Investor so you do not miss that article.

Disclaimer: The information shared in this article is presented only for educational purposed and is not intended to be taken as Financial Advice or a recommendation for the purchase of any securities. The Author, Devrhoid Davis, is NOT a Financial Advisor. Readers are encouraged to speak with their Licensed Financial Advisors when making investment decisions.

Save