Indies Pharma Stock Jamaica Stock Exchange

The Case for Buying Indies Pharma Stock

Indies Pharma (JSE Ticker: $INDIES), while not a high profile, or aggressively marketed Initial Public Offers (IPO), is one of the best we have seen in the capital markets of late. The closest comparison in recent memory is that of Stationery and Office Supplies (JSE ticker: $SOS) which had their IPO in June of 2017.

Advertisement

It is only a few weeks after the listing of the pharmaceutical distribution company. I am looking on in anticipation as to what the next 12 months will bring for INDIES. Admittedly, I am very bullish on the stock and the business itself. It is my view that the company has a very long runway in from of them. One that I would argue is even longer than that of more recent IPOs such as FOSRICH, ELITE and even SOS. All of whom I believe are amazing companies. In this brief analysis, we will explore why Indies Pharma may turn out to be an amazing growth stock over the next five years.

Indies Pharma IPO Structure and Valuation

Ads by Google

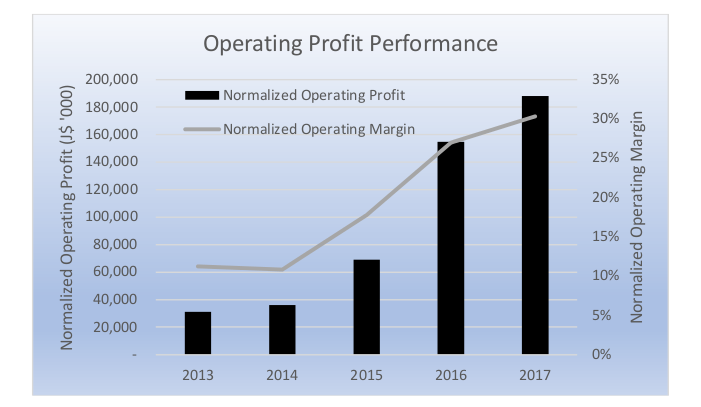

Firstly, Gk Capital Management must be commended for the successful listing. Indies Pharma is not a very well known company. The small company is family-run but has been growing steadily over the last 5 years as demonstrated by the graphs below.

In order to become a public company, Indies offered shares to the investing public on July 05 of 2018.

Suggested Reading: How do Companies become public companies.

The company offered a total of The 173,983,149 new shares in the initial public offering. However only 30,000,000 shares were offered to investors in the general public. The shares were offered at an invitation price of $1.50 per share. This was a very favourable price considering the economic climate and the growth in the company.

Sponsored

Additionally, investors were able to purchase as little as 1000 shares, demonstrating that even the smallest investor could part-take in the offer. Most significant however, was the valuation of the shares in respect to the previous years earnings. With 2017 earnings of $0.15 the Price – Earnings ratio (PE) of the company at the time of the offer was 10.00. This was well below the average PE of the market (~22 Times Earnings) and significantly below the PE of other IPOs that came to market over the 3 years spanning 2015-2018. Caribbean Value Investor’s data shows many companies came to market with PEs between 15 and 30 times historic earnings.

We will come back to this after taking a brief look at two other important factors that bolster our optimistic position on the company.

Tax Free Income and lower debt

Having successfully listed on the Junior Market of the Jamaica Stock Exchange, Indies Pharma now qualifies for 5 years exemption from corporate income tax. That means that over the next few years the company will not have to shell out 33% of gross profits. This is money that could be reinvested into the operations of the company or paid out to shareholders in the form of dividends. In either case, the profile of the company will increase, shareholders will befit, and, this could very well translate into an increase in price of the shares.

We can also mention the fact that 33% of gross profits will be preserved by the company which will mean improved earnings over the next quarter even if sales do not improve. Note well, stagnation in sales is highly improbable for reasons I will explain next.

Sponsored

Notwithstanding, one of the objectives outlined in the use of funds was the reduction of debt. The company stated that they would be repaying their debt of US$1.056 million (Ja$142,560,00) to Bioprist Holdings. They will also be clearing a Ja$ 60,840,000 debt held between First Global and NCB Commercial Bank. This means the company would have effectively erased 203,400,000 in total debt from its balance sheet and the cost of servicing those debts from its income statement. Indies Pharma recorded profits from operations of 188,173,000 in 2017, and paid interest on loans of 15,827,852 along with taxes of Ja$35,043,865 resulting in net profits of 137,301,358. As a public company Indies Pharma would have retained all of the 188 million after using the IPO funds assuming there were no improvements in operation.

Suggested Article: TOP 10 Largest companies on the Jamaica Stock Exchange

Company Growth

In the last few months, there have been numerous reports of there being a shortage of prescription medication on the island. While there is a multitude of competitors in the space, none of them have the unique position that has been granted to Indies following its IPO. Indies Pharma’s successful listing added close to 250 million dollars in cash to the company’s coffers. Once the funds are deployed for their intended use in debt servicing, Indies Pharma will have about 20,000,000 in cash. They will now armed with the capital necessary to acquire the well needed drugs and to make them available to their customers. As we already mentioned, the profits made in doing this will be tax free. The company will also retain a greater portion of their revenues since they will not have the installments to pay in the debt.

Advertisement

Indies Pharma also has a very capable management team. The company is led by a very accomplished and ambitious expert in the form of their CEO Dr. Guna Muppuri. The CEO has pledged to introduce 10 new drugs every year for the next five years, ramping up subsequent years until they are introducing 50 new drugs per year. While this might seem a lofty goal, we must credit the CEO for his vision. Indies Pharma has all of the boxes ticked for an excellent growth company.

Back to that PE Multiple argument

Now then, we have looked at the possibility of the company to realise even greater net profits with the recent listing. We have shown that the company’s success in listing on the JSE means less taxes on profits. We have shown that the presence of a significant demand for pharmaceuticals has created a tremendous opportunity for providers. We have further shown that Indies is in the best position to take advantage of the demand in the current market.

Let us take a conservative look at the what the forward PE might be and what I will call the Future PE. The forward PE is calculated using today’s price of the stock and an estimated value for the earnings some time in the future. Let’s look at the forward PE first. As of Friday August 31, 2018, bids for Indies Pharma stock were as high as Ja$3.23. The stock closed with a PE of 21.65 times earnings. 2017 Earnings came in at $0.15. Assuming a 30% increase in net sales and a 33% increase in net earnings from point 2, earnings would be 0.24 making for a PE of 13.5, significantly below the Junior Market average of 25.51.

Ads by Google

The Future PE as I have defined it, is somewhat easier, we assume that the future PE will be that of the Market and from their, use the improved earning of 0.24 to arrive at a target price for the stock. So, let’s take it that the stock will catch to the current market PE. Important note: Newly listed companies tend to have significantly higher PE Multiples than the average of the market. Let us also assume that the company does earn 0.24 for the 2018 year. The target price would be PE* Earnings which gives us the stunning, yet speculative value of $6.12 per share. That value represents an 89% return.

Historical Context for our bull thesis on Indies Pharma

Over the last 3 years, the Jamaica Stock Exchange (JSE) has seen a number of quality companies make their debut on the Junior Market of the JSE. Some of the ones that Caribbean Value Investor watched most closely were Stationery and Office Supplies, Elite Diagnostics Imaging Services Limited, FosRich and Everything Fresh Limited. We held optimistic views about FosRich, Elite Diagnostics and Stationery and Office Supplies. Conversely, we cautioned readers to be careful of small companies that overestimated their market, valued their stock in line with well established conglomerates and had high Cost of Goods Sold (COGs) coupled with low margins.

Advertisement

As the investing public would have it, SOS, which IPOed at $2.00 shot to $4.00 within a few weeks of being listed. It hit it’s first resistance at $5.00 but brokeout after reporting strong improvements in earnings, the acquisition of a new real estate and plans to start manufacturing exercise writing books under the SEEK Brand. The stock traded as high as $10.00, a 5X return for the shareholder who bought in at the IPO. The price of $10.00 also represented a 100% increase over the resistance price.

For more detailed analysis, contact us at: info@caribbeanvalueinvestor.com

Disclaimer: The opinions expressed in this article are solely those of the authors and are in no way intended to reflect management’s views. Further, all information provided on Caribbean Value Investor is strictly for educational purposes. Caribbean Value Investor, its Directors, Employees and Stakeholders accept no liability in respect to losses experienced by readers.

Pingback:Lumber Depot Lists on the JSE - Caribbean Value Investor