Indies Pharma IPO- Is it a buy?

Indies Pharma IPO

Indies Pharma Jamaica Limited markets and distributes prescription and non-prescription generic pharmaceutical products throughout Jamaica covering more than 21 disease segments. More than 150 drugs are offered allowing the company to benefit from diversified revenue stream with no single range of products accounting for more than 12.5% of revenues. On average the company has introduced 10 – 15 products per year. Indies Pharma is focused on marketing and distributing the Bioprist brand of generic pharmaceutical products which is owned and licensed by its holding company, Bioprist Holdings, a company which is incorporated in St. Lucea. According to the prospectus “the products distributed by the Company are contract manufactured for and supplied to the Bioprist Group by 12 contract manufacturing pharmaceutical companies from India and Bangladesh, and then onto the Company for non-exclusive distribution”. Indies Pharma prides itself on quality customer services, efficient and effective product movement. To this end the company can deliver products within 24 to 48 hours upon receipt of a purchase order.

Advertisement

Indies Pharma Initial Public Offering (IPO) is seeking JMD $387,216,970.05 for 266,507,330 shares of which 39,500,000 are for the general public at a price of JMD $1.50. The COO Vishnu Muppuri will be selling 92,534,181 shares at a value of JMD $138,786,000. The remaining funds of about JMD $248,430,000 will be used by the company for debt repayment and working capital. The company owes about JMD $194,031,314 of debt which will be cleared by the IPO. Base on 2017 audited financials this would cut the finance cost by more than $15 million and along with the tax benefits that would be gained from listing on the Junior market, add a further $35 million to the profits. Base on these factors and the compound annual growth rate of 22.1% that was given for revenues, an EPS of around JMD $0.16 is possible within the next 12 months. Current metrics can be viewed below.

Earns per share $0.10

Price to Earnings Ratio 14.56

Book Value $0.28

Return on equity 37%

Return on asset 22%

Debt to equity ratio 67%

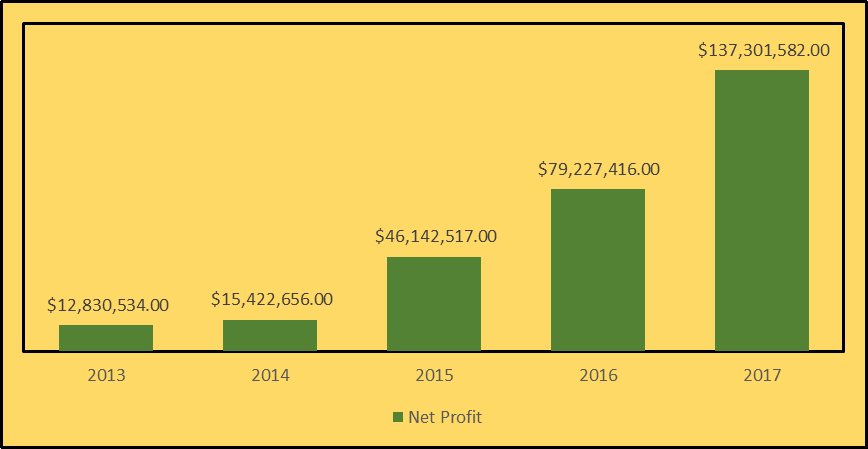

The company appears to have fairly valued metrics which indicates that the company can be bought with the expectation of a short-term benefit from the tax incentives that will be received. Over the past 5 years, Indies Pharma has demonstrated consistent net profit earnings. The last three years show tremendous growth as the image above displays. However, the company is not without challenges. With such a diverse array of products, the question that Indies Pharma must answer is if they can control their cost of goods sold (COGS) and achieve a timely inventory turnover. The company is restricted in marketing as local laws prevent the company from advertising prescription drugs.

Advertisement

Therefore, the cost to acquire customer in this competitive environment may increase due to the company being forced to engaged in indirect marketing through representatives that interact with the doctors to promote their products. Customers therefore are left with no power in suggesting their preferred medication. Indies Pharma would be the second pharmaceutical company to be listed (the other being Lasco Pharmaceuticals under Lasco Distributors) on the Junior market.

Suggested Reading: The Case of Pfizer vs Lasco Distributors

With the Indies Pharma IPO offer being fairly valued and only JMD $387,216,970.05 being sought with 39,500,000 shares available for the general public, the IPO is relatively small. Against this backdrop, Caribbbean Value Investor expects the Indies Pharma IPO to be oversubscribed. The lead broker for the Indies Pharma IPO is GK Capital Management Limited and the co-broker is Sagicor Investment Jamaica Limited.

Disclaimer: The opinions expressed in this article are solely those of the author (s) and are in no way intended to reflect management’s views. Further, all information provided on Caribbean Value Investor is strictly for educational purposes. Caribbean Value Investor, its Directors, Employees and Stakeholders accept no liability in respect to gains or losses experienced by readers.

Pingback:Indies Pharma Continues to Perform - Caribbean Value Investor